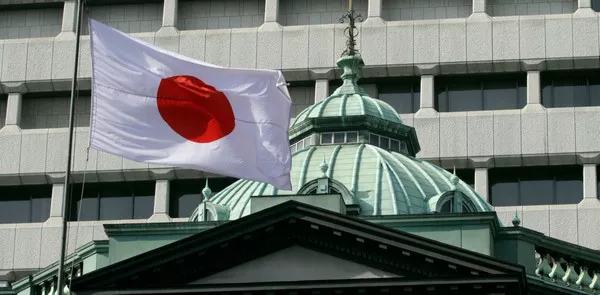

The Bank of Japan (BOJ) plays a pivotal role in shaping the economic landscape of Japan through its monetary policy. As one of the world’s major central banks, the BOJ employs various tools and strategies to achieve its objectives. This article aims to provide a detailed examination of the Bank of Japan’s policy, exploring its goals, instruments, and the broader economic context.

I. Historical Context:

To understand the current monetary policy of the Bank of Japan, it is essential to delve into its historical context. The BOJ was established in 1882 and has undergone significant transformations over the years. Initially, its primary focus was on the stability of the Japanese yen and the gold standard. However, as economic conditions evolved, so did the objectives and tools of the BOJ.

II. Objectives of the Bank of Japan:

The Bank of Japan is guided by a dual mandate: price stability and economic growth. Achieving and maintaining price stability is crucial for sustaining a healthy economic environment. The BOJ sets a target for inflation and adjusts its policy tools to meet this goal. Additionally, the central bank aims to support overall economic growth, employment, and financial stability.

III. Monetary Policy Tools:

The Bank of Japan employs a range of monetary policy tools to influence economic conditions. These tools can be broadly categorized into conventional and unconventional measures.

Conventional Tools:

a. Open Market Operations: The BOJ engages in buying and selling government securities to control the money supply and interest rates.

b. Discount Rate: The discount rate, set by the BOJ, influences short-term interest rates and borrowing costs for financial institutions.

Unconventional Tools:

a. Quantitative and Qualitative Monetary Easing (QQE): The BOJ introduced QQE to combat deflation by increasing the monetary base and lowering long-term interest rates.

b. Negative Interest Rate Policy (NIRP): By setting negative interest rates on excess reserves held by financial institutions, the BOJ aims to encourage lending and spending.

IV. Inflation Targeting:

A key aspect of the Bank of Japan’s policy is its commitment to achieving a target inflation rate. The BOJ introduced an inflation target of 2% in 2013, aiming to combat prolonged deflation. However, achieving this target has proven challenging, and the central bank has employed various measures to stimulate inflation.

V. Challenges and Criticisms:

The Bank of Japan faces several challenges and criticisms in its pursuit of monetary policy objectives. These challenges include the impact of demographic trends, a persistent low-interest-rate environment, and the effectiveness of unconventional monetary policies. Critics argue that the BOJ’s measures have had limited success in achieving sustained economic growth and reaching the inflation target.

VI. Exchange Rate Dynamics:

Given Japan’s export-oriented economy, exchange rate dynamics play a crucial role in the effectiveness of the Bank of Japan’s policy. The central bank monitors and assesses the impact of exchange rate movements on economic conditions. Interventions in the foreign exchange market are occasionally employed to address excessive volatility and maintain economic stability.

VII. Coordination with Fiscal Policy:

Effective monetary policy often requires coordination with fiscal policy measures. The Bank of Japan collaborates with the government to ensure a comprehensive approach to economic management. This coordination is particularly crucial during periods of economic downturns or crises.

VIII. Lessons from Abenomics:

The Abenomics initiative, launched by Prime Minister Shinzo Abe, aimed to revitalize the Japanese economy through a combination of monetary policy, fiscal stimulus, and structural reforms. Examining the outcomes and challenges of Abenomics provides valuable insights into the complexities of implementing a multifaceted economic strategy.

IX. Future Directions:

As the global economic landscape evolves, the Bank of Japan continues to adapt its policies to address emerging challenges. The future directions of the BOJ’s policy may involve further innovations in monetary tools, enhanced communication strategies, and a continued focus on achieving sustainable economic growth.

Conclusion:

In conclusion, the Bank of Japan’s policy is a multifaceted framework designed to achieve price stability, economic growth, and financial stability. By employing a variety of conventional and unconventional tools, the BOJ seeks to navigate the challenges posed by the global economy. Understanding the intricacies of the Bank of Japan’s policy is essential for policymakers, economists, and the general public alike, as it directly influences the economic well-being of Japan and reverberates throughout the international financial system.