The global financial landscape is intricately woven with currency relationships that impact international trade, investment, and economic stability. One such relationship that holds significance in the European context is that between the Swedish Krona (SEK) and the Euro (EUR). This article aims to provide a comprehensive exploration of the dynamic connections, historical context, and influencing factors that characterize the relationship between the Swedish Krona and Euro.

Understanding the Swedish Krona:

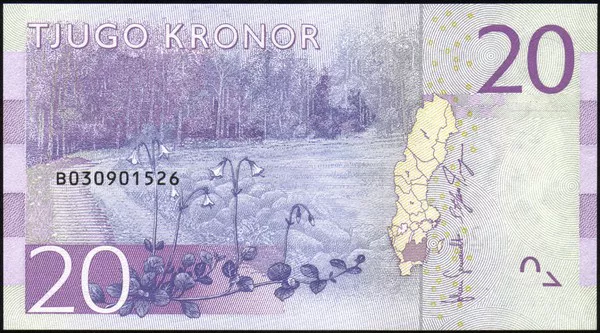

The Swedish Krona, denoted as SEK, has been the official currency of Sweden since 1873. As a floating currency, its exchange rate is determined by the foreign exchange market, influenced by various economic factors such as interest rates, inflation, and overall economic performance. The Swedish Krona is abbreviated as SEK, derived from the Swedish word “krona,” meaning crown.

Understanding the Euro:

The Euro, denoted as EUR, is the official currency of the Eurozone, a group of European Union (EU) member countries that have adopted the Euro. Introduced in 1999, the Euro became a physical currency in 2002. It is one of the most widely used and traded currencies globally, serving as a symbol of economic integration within the Eurozone.

Historical Overview of the Euro:

The Euro’s inception marked a significant milestone in the history of European economic cooperation. The idea of a common European currency was born out of a desire to foster economic integration, facilitate cross-border trade, and promote a sense of unity among EU member states. The Eurozone comprises countries that have adopted the Euro as their official currency, sharing a common monetary policy governed by the European Central Bank (ECB).

Exchange Rate Mechanisms:

The relationship between the Swedish Krona and Euro is influenced by the foreign exchange market, where currencies are traded. Exchange rates are determined by the interplay of supply and demand dynamics, reflecting the relative strengths and weaknesses of the Swedish and Eurozone economies. Both currencies participate in this complex market, where traders, investors, and central banks play pivotal roles.

Factors Influencing the SEK/EUR Exchange Rate:

Several factors contribute to the fluctuations and dynamics of the SEK/EUR exchange rate. Understanding these factors is crucial for comprehending the relationship between the Swedish Krona and Euro:

Interest Rates:

Central banks, including the Swedish Riksbank and the European Central Bank (ECB), set interest rates that influence currency values. Higher interest rates in Sweden may attract foreign capital, increasing demand for the Swedish Krona and impacting the SEK/EUR exchange rate.

Economic Indicators:

Economic indicators such as GDP growth, unemployment rates, and manufacturing data play a role in shaping market sentiment. Positive economic performance in Sweden or the Eurozone can impact the perception of the respective currencies and influence their exchange rates.

Inflation Rates:

Inflation differentials between Sweden and the Eurozone can impact currency values. Lower inflation in Sweden compared to the Eurozone may lead to an appreciation of the Swedish Krona relative to the Euro.

Political Stability:

Political stability is a key factor influencing investor confidence. Political uncertainties or instability in either Sweden or the Eurozone can impact the SEK/EUR exchange rate as investors seek safer assets.

Trade Balances:

The trade balances of Sweden and Eurozone countries can affect the SEK/EUR exchange rate. A trade surplus in Sweden may increase demand for the Swedish Krona, while a trade deficit may have the opposite effect.

Global Economic Conditions:

Global economic conditions, such as changes in commodity prices, geopolitical events, and broader economic trends, can impact both the Swedish Krona and Euro. Investors often seek safe-haven currencies during times of global uncertainty.

Historical Performance:

The historical performance of the SEK/EUR exchange rate provides insights into the evolving relationship between the Swedish Krona and Euro. Over the years, various economic events, policy decisions, and global factors have contributed to the fluctuating dynamics of this currency pair.

Euro’s Introduction and Early Years:

The introduction of the Euro in 1999 marked a period of adjustment for currency relationships across Europe. In the initial years, the Euro experienced both challenges and successes, influencing its parity with other currencies, including the Swedish Krona.

Global Financial Crisis (2008):

The global financial crisis in 2008 had widespread implications for currency markets. Both the Swedish Krona and Euro experienced volatility, with investors seeking safe-haven currencies. The Eurozone’s response to the crisis and subsequent economic recovery influenced the SEK/EUR exchange rate.

Eurozone Debt Crisis (2010-2012):

The Eurozone debt crisis, characterized by fiscal challenges in several member countries, impacted the Euro’s value. The Swedish Krona, often considered a stable currency, saw fluctuations during this period, reflecting the broader economic uncertainties in Europe.

Swedish Economic Resilience:

Sweden’s economic resilience and robust performance in the aftermath of global crises have contributed to the strength of the Swedish Krona. Investors may view the Swedish economy as a safe haven during turbulent times, impacting the SEK/EUR exchange rate.

Recent Trends and Economic Integration:

Recent years have seen ongoing economic integration within the European Union and the Eurozone. The strengthening of economic ties and collaborative policy efforts influence the SEK/EUR relationship, reflecting the broader dynamics of European economic unity.

Current Economic Landscape:

The economic landscape shaping the relationship between the Swedish Krona and Euro is characterized by several key factors:

Interest Rate Policies:

The monetary policies of the Swedish Riksbank and the ECB continue to impact the SEK/EUR exchange rate. Divergent interest rate paths between Sweden and the Eurozone can lead to shifts in currency values.

Global Economic Conditions:

Ongoing global economic conditions, including trade tensions, the impact of the COVID-19 pandemic, and geopolitical events, influence investor sentiment and contribute to currency market dynamics.

Pandemic Response and Recovery:

The economic response to the COVID-19 pandemic has been a significant factor influencing currency values. Both Sweden and Eurozone countries have implemented stimulus measures, and the pace of economic recovery may influence the SEK/EUR exchange rate.

Trade Dynamics:

Trade dynamics, including Sweden’s export-oriented economy and its trade relationships within and outside the Eurozone, play a role in shaping the SEK/EUR relationship. Changes in trade balances can impact currency values.

European Integration Efforts:

Ongoing efforts toward European integration, discussions about fiscal policy coordination, and the potential for further economic collaboration within the Eurozone contribute to the evolving relationship between the Swedish Krona and Euro.

Future Outlook:

The future outlook for the relationship between the Swedish Krona and Euro is subject to a range of economic, political, and global factors. Some considerations for the future include:

Economic Recovery:

The pace and sustainability of economic recovery in both Sweden and the Eurozone will influence currency values. Policy measures, employment trends, and consumer spending patterns are key indicators to watch.

Monetary Policy Decisions:

The monetary policy decisions of the Swedish Riksbank and ECB will continue to impact the SEK/EUR exchange rate. Interest rate differentials and central bank communications will be closely monitored by market participants.

Global Economic Trends:

Global economic trends, including shifts in trade dynamics, technological advancements, and geopolitical developments, will contribute to the overall outlook for the SEK/EUR relationship.

European Union Developments:

Developments within the European Union, such as discussions on fiscal integration, reforms, and the potential expansion of the Eurozone, will shape the context within which the Swedish Krona and Euro interact.

Political and Geopolitical Factors:

Political stability within Sweden and the Eurozone, as well as geopolitical events with global implications, can impact investor confidence and influence currency values.

See Also: Things About Swedish Currency You May Not Know

Conclusion:

The relationship between the Swedish Krona and Euro is a dynamic interplay of economic forces, policy decisions, and global trends. From historical milestones like the Euro’s introduction to contemporary challenges such as the global pandemic, these currencies reflect the ever-evolving nature of international finance.

As Sweden and the Eurozone navigate economic recoveries, implement policy measures, and adapt to changing global conditions, the SEK/EUR exchange rate will continue to respond to these dynamics. Investors, businesses, and policymakers alike will closely monitor this relationship, recognizing its importance in the broader context of European economic integration and global financial stability.