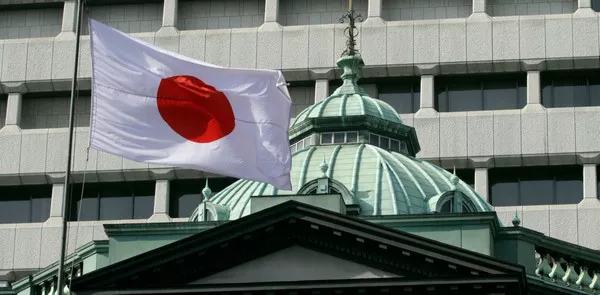

More importantly, the path for short-term interest rates going forward will be set at an appropriate level so that consumer inflation remains close to the Bank of Japan’s 2% target

Bond Yield Curve Control Policy and Bank of Japan Bond Purchase Management Are Interrelated

When we end or adjust the bond yield curve control policy, we will consider how to announce news about bond buying operations.

Adjusting the bond yield control curve policy means allowing yields to move more freely, but we will ensure that this does not result in a significant change in the size of our bond purchases or a sharp rise in bond yields

If inflation is foreseen to reach 2%, it would be natural to stop ETF and Japan Real Estate Investment Trust (J-REIT) buying.

Even if we stop buying ETFs and J-REITs, the impact on the market will not be great

What to do with our large holdings of ETFs, J-Reits, is a different question that will take time to think about.

We expect service prices to rise, along with wage increases.