Currency strength is one of the key indicators of a country’s economic health. A strong currency not only reflects a nation’s financial stability but also its purchasing power on the international stage. The value of a currency can fluctuate due to various factors including interest rates, inflation, and political stability. As of 2025, several currencies dominate the global market, showcasing the economic prowess of their respective countries. In this article, we explore the top 10 strongest currencies in the world based on their exchange rates against the U.S. dollar.

1. Kuwaiti Dinar (KWD)

Overview

The Kuwaiti Dinar (KWD) is consistently ranked as the strongest currency in the world. As of 2025, one Kuwaiti Dinar is worth more than three U.S. dollars, making it the most valuable currency globally. This strength is largely due to Kuwait’s vast oil reserves and stable financial management. Kuwait’s economy is heavily reliant on oil exports, and the country’s government has managed to maintain fiscal discipline, which has contributed to the dinar’s value.

Factors Behind Strength

Kuwait is one of the largest oil exporters in the world, and the oil industry drives the nation’s economy. The demand for oil, coupled with Kuwait’s large foreign exchange reserves, underpins the stability and strength of its currency. Additionally, the country’s minimal debt levels and stable political system help maintain the strength of the Kuwaiti Dinar.

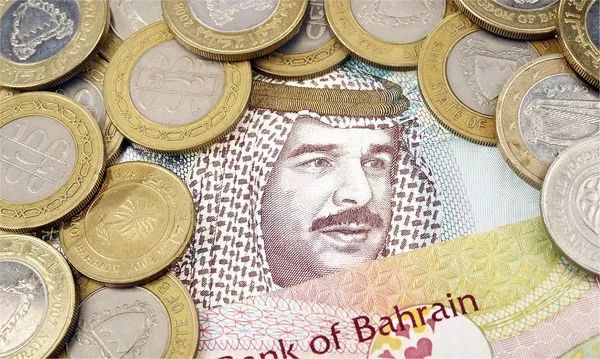

2. Bahraini Dinar (BHD)

Overview

The Bahraini Dinar (BHD) is the second strongest currency in the world as of 2025. Like the Kuwaiti Dinar, the strength of the Bahraini Dinar is closely linked to Bahrain’s oil wealth. Despite being a smaller economy compared to Kuwait, Bahrain has managed to maintain a robust currency, with one Bahraini Dinar worth approximately 2.65 U.S. dollars.

Factors Behind Strength

Bahrain is an important financial hub in the Middle East, with a thriving banking sector and strong ties to the oil industry. The country has diversified its economy to include services such as banking, insurance, and telecommunications, though oil remains the key driver of its economic strength. Bahrain’s pegged exchange rate system helps stabilize the value of its currency.

3. Omani Rial (OMR)

Overview

The Omani Rial (OMR) ranks third in terms of strength. One Omani Rial is valued at around 2.60 U.S. dollars. Oman’s currency strength is tied to its oil and gas sector, which is a key contributor to its GDP. Despite a relatively small population, Oman’s sound economic policies have ensured the strength of the Rial.

Factors Behind Strength

Oman’s oil reserves are smaller than those of its Gulf neighbors, but the country has been able to maintain a relatively high standard of living. The Omani government has also diversified the economy into tourism, fishing, and agriculture. The Omani Rial is pegged to the U.S. dollar, which provides additional stability to the currency.

4. Jordanian Dinar (JOD)

Overview

The Jordanian Dinar (JOD) is another strong currency, ranking fourth in the world in 2025. One Jordanian Dinar is valued at approximately 1.41 U.S. dollars. Despite Jordan’s limited natural resources, the Jordanian Dinar remains strong due to the country’s stable economy and strategic geopolitical position.

Factors Behind Strength

Jordan does not have significant oil or gas reserves, but it has a well-developed industrial sector, which includes mining and manufacturing. Additionally, the country’s foreign aid, especially from the United States and other Western countries, has bolstered its economy. The Jordanian Dinar is pegged to the U.S. dollar, which helps stabilize its value.

5. British Pound Sterling (GBP)

Overview

The British Pound Sterling (GBP) is the fifth strongest currency as of 2025. One British Pound is worth about 1.28 U.S. dollars. As one of the world’s oldest currencies, the British Pound has a significant place in the global financial system and is used widely in international trade.

Factors Behind Strength

The strength of the British Pound is attributed to the United Kingdom’s strong and diversified economy. The financial services sector, particularly in London, plays a major role in global markets, and the UK is a major trading nation. The British Pound benefits from high investor confidence and the relatively strong economic outlook of the UK, despite challenges posed by Brexit.

6. Gibraltar Pound (GIP)

Overview

The Gibraltar Pound (GIP) is another strong currency, though it is not as widely known as some of the other currencies in this list. The currency is pegged to the British Pound at a 1:1 ratio, which helps stabilize its value. As of 2025, the Gibraltar Pound is valued similarly to the British Pound.

Factors Behind Strength

Gibraltar’s economy is driven by finance, tourism, and shipping. The territory benefits from its strategic location at the entrance to the Mediterranean Sea, making it an important shipping and trade hub. The pegging of the Gibraltar Pound to the British Pound ensures that the currency remains strong.

7. Cayman Islands Dollar (KYD)

Overview

The Cayman Islands Dollar (KYD) is the official currency of the Cayman Islands, a British Overseas Territory in the Caribbean. As of 2025, the Cayman Islands Dollar is valued at about 1.20 U.S. dollars. The currency’s strength is due to the islands’ thriving financial sector and tourism industry.

Factors Behind Strength

The Cayman Islands are known for their robust financial services industry, including banking, hedge funds, and insurance. The economy is also bolstered by tourism, with many visitors flocking to the islands for its pristine beaches and luxury resorts. The Cayman Islands Dollar is pegged to the U.S. dollar, providing additional stability.

8. Euro (EUR)

Overview

The Euro (EUR) is the official currency of the Eurozone, comprising 19 of the 27 European Union (EU) member states. The Euro is the second-most traded currency in the world after the U.S. dollar, and as of 2025, it is valued at about 1.06 U.S. dollars.

Factors Behind Strength

The Eurozone is one of the largest economic areas in the world, with a combined GDP that rivals that of the United States. The Euro’s strength is largely attributed to the size and economic diversity of the region. The currency benefits from being the reserve currency of choice for many international transactions, and the European Central Bank (ECB) plays a key role in maintaining its stability.

9. Swiss Franc (CHF)

Overview

The Swiss Franc (CHF) is the currency of Switzerland, a country known for its strong financial sector and stable economy. As of 2025, the Swiss Franc is valued at about 1.10 U.S. dollars. The Swiss Franc is often considered a “safe-haven” currency, meaning it tends to strengthen during times of global economic uncertainty.

Factors Behind Strength

Switzerland’s economy is built on finance, pharmaceuticals, and high-tech industries. The Swiss government has a long-standing policy of fiscal prudence, and the country enjoys low levels of public debt. Switzerland’s stable political environment and strong banking system further contribute to the strength of the Swiss Franc.

10. Singapore Dollar (SGD)

Overview

The Singapore Dollar (SGD) rounds out the list of the top ten strongest currencies as of 2025. One Singapore Dollar is valued at approximately 0.74 U.S. dollars. Singapore is a global financial hub with a highly developed economy, which supports the strength of its currency.

Factors Behind Strength

Singapore has a diversified economy that includes finance, technology, manufacturing, and trade. The country’s strategic location as a global shipping and trade center also boosts the value of its currency. The Singaporean government’s effective economic policies, as well as the country’s high levels of foreign exchange reserves, help maintain the strength of the Singapore Dollar.

Conclusion

The strongest currencies in the world as of 2025 are driven by a combination of economic strength, stable political systems, and effective monetary policies. While some countries, like Kuwait and Bahrain, owe their currency strength to their vast oil reserves, others, like Switzerland and Singapore, have built robust economies based on finance, technology, and trade. Understanding the factors behind these currencies’ strength is essential for investors, policymakers, and businesses operating in the global market.

As currency values fluctuate in response to economic conditions, geopolitical events, and market sentiment, the ranking of the world’s strongest currencies may change over time. However, these ten currencies are expected to remain at the top due to the strong economic foundations that underpin their value.

You Might Be Interested In:

- Is EUR/USD Good for Scalping?

- Top 5 Disadvantages of Currency Appreciation

- Top 4 Advantages of Currency Appreciation