Currency conversion is an integral part of international travel, trade, and financial transactions. For those dealing with Burundian Francs, understanding how to convert the currency efficiently is essential. In this article, we present a concise and comprehensive guide on converting Burundian Francs in three simple steps. From assessing the current exchange rates to choosing the right method for conversion, this guide aims to empower individuals with the knowledge needed to navigate the process seamlessly.

Step 1: Understand the Current Exchange Rates

Before initiating any currency conversion, it is crucial to have a clear understanding of the current exchange rates. The exchange rate represents the value of one currency in terms of another and is influenced by various factors, including economic conditions, geopolitical events, and market sentiment.

Here’s how you can access and interpret exchange rates for Burundian Francs:

Check Financial News Websites:

Financial news websites and platforms regularly provide up-to-date exchange rates. Look for reputable sources such as financial news agencies, central banks, or financial market platforms. These sources often display real-time rates and historical trends.

Use Online Currency Converters:

Online currency converters are user-friendly tools that allow you to check current exchange rates quickly. Many financial websites and currency converter apps provide real-time rates and the ability to convert Burundian Francs into other currencies or vice versa.

Consult with Banks or Currency Exchange Offices:

Banks and currency exchange offices typically display their current exchange rates either on their websites or at physical locations. Keep in mind that the rates offered by banks may include fees or commissions, so it’s essential to inquire about any additional charges.

Monitor Mobile Apps:

Numerous mobile apps specialize in providing exchange rate information. These apps often come with features such as rate alerts and historical data, enabling users to make informed decisions about when to convert their Burundian Francs.

Understanding the current exchange rates is the first step towards making informed decisions when converting Burundian Francs. By keeping track of fluctuations, you can identify opportune moments for currency conversion.

Step 2: Choose the Right Conversion Method

Once you are aware of the current exchange rates, the next step is to select the most suitable method for converting your Burundian Francs. Several options are available, each with its advantages and considerations.

1. Banks and Financial Institutions:

Banks are conventional and reliable institutions for currency conversion. Visit your local bank or a bank in Burundi that provides foreign exchange services. You can either conduct the transaction at the bank counter or use ATMs if you have a debit or credit card.

Pros:

Security and reliability.

Access to a wide range of currencies.

Banks often provide competitive exchange rates.

Cons:

Limited operating hours.

Some banks may charge transaction fees or offer less favorable rates.

2. Currency Exchange Offices:

Currency exchange offices, commonly found at airports, border crossings, and major cities, specialize in providing foreign currency exchange services. These establishments cater to both tourists and locals seeking to convert currencies.

Pros:

Convenient locations, especially at airports and tourist hubs.

Competitive rates, particularly in popular tourist destinations.

Cons:

May charge higher fees or offer less favorable rates in some cases.

Operating hours may vary.

3. Online Currency Exchange Platforms:

Online platforms offer the convenience of currency conversion from the comfort of your home. Various websites and mobile apps facilitate the exchange of Burundian Francs for other currencies.

Pros:

Accessibility from anywhere with an internet connection.

Real-time exchange rates.

Some platforms offer additional features such as rate alerts.

Cons:

May incur transaction fees.

Limited physical presence for issue resolution.

4. Local Markets and Street Vendors:

In some regions, local markets and street vendors may offer informal currency exchange services. While this option may be accessible and convenient, it’s essential to exercise caution due to the lack of regulation.

Pros:

Convenient in local settings.

May offer flexibility in negotiation.

Cons:

Lack of regulation and security.

Exchange rates may not be competitive.

Risk of counterfeit currency.

5. ATMs (Automated Teller Machines):

ATMs provide a convenient way to obtain local currency. In Burundi, as in many countries, ATMs are prevalent in urban centers and tourist areas. Ensure your debit or credit card is compatible with local ATMs and inform your bank of your travel plans to avoid any issues.

Pros:

Convenient and widely available.

Provides access to local currency.

Typically offers competitive exchange rates.

Cons:

May incur withdrawal fees and foreign transaction charges.

Limited to the amount you can withdraw per day.

6. Hotel Concierge Services:

Some hotels offer currency exchange services for their guests. While this can be a convenient option, it’s essential to be aware that hotel exchange rates may not be as favorable as those offered by banks or dedicated exchange offices.

Pros:

Convenient for travelers staying at the hotel.

Exchange services may be available outside regular banking hours.

Cons:

Rates may be less competitive.

Limited to hotel operating hours.

7. Peer-to-Peer Transactions:

In certain situations, especially within expatriate communities or among travelers, peer-to-peer transactions may occur. This informal method involves individuals exchanging currencies directly with each other.

Pros:

Flexibility and potential for favorable rates.

Informal and personalized transactions.

Cons:

Limited availability and reliance on personal networks.

Higher risk of counterfeit currency.

8. Foreign Exchange Bureaus:

Specialized foreign exchange bureaus operate in some countries, providing currency conversion services. These bureaus often cater to tourists and may offer competitive rates.

Pros:

Specialized in currency exchange.

Convenient locations in tourist areas.

Cons:

Rates may not always be the most competitive.

Limited availability in certain regions.

Step 3: Execute the Currency Conversion

Once you’ve chosen the method that aligns with your preferences and requirements, it’s time to execute the currency conversion. Follow these steps to ensure a smooth and successful transaction:

Prepare the Necessary Documents:

Depending on the conversion method chosen, you may need to present identification documents, such as a passport or ID, especially when dealing with banks or currency exchange offices. Ensure you have all necessary paperwork to facilitate the transaction.

Check for Fees and Commissions:

Be aware of any fees or commissions associated with the chosen method. Some providers may charge a flat fee or a percentage of the transaction amount. Factor these costs into your decision-making process.

Verify the Exchange Rate:

Before finalizing the transaction, confirm the exchange rate being offered. Compare it to the current market rate to ensure you are getting a fair deal. If using online platforms or apps, double-check the displayed rate before confirming the transaction.

Keep an Eye on Your Budget:

If you are exchanging currency for travel purposes, ensure that the amount you convert aligns with your budget for the trip. Be mindful of any additional expenses, such as accommodation, transportation, and daily expenses, when determining the amount to convert.

Secure Your Receipt or Confirmation:

Regardless of the conversion method, it’s essential to retain a receipt or confirmation of the transaction. This document serves as proof of the exchange rate, the amount converted, and any fees incurred. Keep it in a secure location for your records.

Monitor for Exchange Rate Changes:

Exchange rates can fluctuate, so if you have the flexibility to choose when to convert your Burundian Francs, consider monitoring the rates for favorable opportunities. Some online platforms offer rate alerts, allowing you to receive notifications when your target exchange rate is reached.

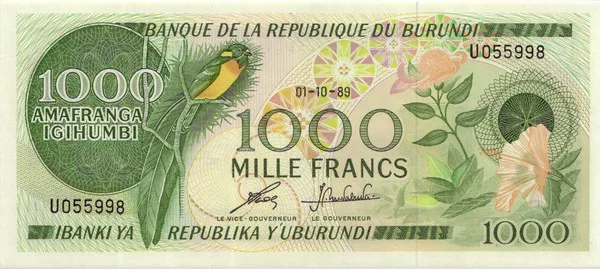

See Also: Burundi Franc (BIF) Currency: History, Symbol, Codes & Denominations

Conclusion

Converting Burundian Francs is a straightforward process when approached with the right knowledge and understanding. By following these three steps – understanding current exchange rates, choosing the right conversion method, and executing the transaction carefully – individuals can navigate currency conversion with confidence.

Whether you opt for the convenience of banks, the accessibility of ATMs, or the flexibility of online platforms, being informed about exchange rates, fees, and the reliability of service providers is crucial. By making informed decisions at each step, you can ensure a seamless and cost-effective currency conversion experience, whether you are traveling, conducting business, or managing international transactions.