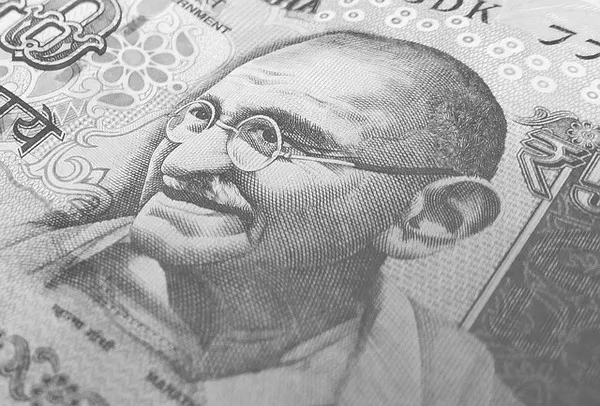

The Indian rupee weakened on Tuesday as state banks bought dollars. Lower speculation that the US Federal Reserve (Fed) may cut interest rates in June provided some support to the dollar against the rupee. The Federal Reserve is widely expected to keep interest rates steady for a fifth consecutive time at its March meeting on Wednesday, insisting on a data-driven effort to ensure a sustainable return to inflation to its 2% target. However, there is still a possibility that Fed officials will reduce the number of rate cuts to two from the three expected earlier this year.

U.S. building permits and housing starts data for February will be released on Tuesday. Investors will be paying close attention to Wednesday’s Federal Reserve interest rate decision and will get more clues about the future trajectory of interest rates from Fed Chairman Jerome Powell’s press conference. On Thursday, India will release the S&P Global Manufacturing and Services Purchasing Managers Index.