In an era where digital financial services are rapidly gaining prominence worldwide, the question of whether Cash App, a popular mobile payment platform, operates seamlessly in Afghanistan has become a pertinent inquiry. As the global financial landscape evolves, individuals and businesses seek convenient and efficient methods for conducting transactions. This article aims to explore the compatibility of Cash App in Afghanistan, shedding light on the potential benefits and challenges associated with its usage in this South Asian nation.

The Digital Financial Landscape in Afghanistan

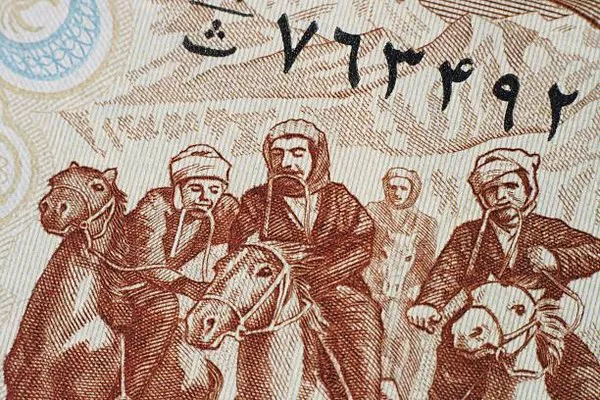

Afghanistan, a country with a rich history and diverse culture, has been undergoing significant economic transformations in recent years. The traditional financial system, while making strides, has faced challenges related to accessibility and inclusivity. The advent of digital financial services presents an opportunity to address these issues, offering a more inclusive and efficient means of conducting transactions.

Cash App Overview

Cash App, developed by Square, Inc., has gained popularity for its user-friendly interface and diverse functionalities. Initially known for peer-to-peer transactions, the platform has expanded to include features such as direct deposit, investing in stocks, and even the ability to purchase and sell cryptocurrencies. While Cash App’s primary market is the United States, its international reach has expanded to include several countries, raising questions about its functionality in regions like Afghanistan.

The Potential Benefits of Cash App in Afghanistan

Financial Inclusion: One of the key advantages of Cash App in Afghanistan lies in its potential to foster financial inclusion. The platform allows users to create accounts and engage in various financial activities without the need for a traditional bank account. In a country where a significant portion of the population remains unbanked, this feature could be a game-changer.

Efficient Cross-Border Transactions: Afghanistan has a considerable diaspora, with many citizens living abroad. Cash App’s ability to facilitate cross-border transactions efficiently could prove valuable for Afghan expatriates looking to send funds back home. The platform’s competitive exchange rates and lower fees for international transfers could make it an attractive option.

Adoption of Digital Currencies: Cash App’s integration of cryptocurrencies provides an avenue for Afghans to explore digital assets. This can be particularly relevant in a global landscape where digital currencies are gaining acceptance. The ability to buy, sell, and hold cryptocurrencies on the platform opens up new financial opportunities for users in Afghanistan.

See Also: What Is The Main Currency In Afghanistan?

Challenges and Considerations

Regulatory Environment: One of the primary challenges for Cash App’s operations in Afghanistan is the regulatory environment. The country’s financial regulatory landscape may not be fully prepared to accommodate the complexities of digital financial services. Ensuring compliance with local regulations is crucial for the platform’s sustainable and legal operation.

Internet Connectivity: The widespread availability and reliability of internet connectivity in Afghanistan pose potential challenges to the seamless functioning of Cash App. A robust internet infrastructure is essential for users to access and utilize the platform effectively. In areas with limited connectivity, efforts to improve digital infrastructure become crucial.

Cultural and Behavioral Factors: Introducing a digital financial platform like Cash App requires an understanding of cultural and behavioral factors that influence financial decisions in Afghanistan. Familiarizing the population with digital payment methods and addressing any skepticism or resistance is vital for widespread adoption.

Conclusion

The potential integration of Cash App in Afghanistan marks a significant step toward modernizing the country’s financial landscape. While the platform offers a range of benefits, it is imperative to address challenges such as regulatory compliance, internet connectivity, and cultural considerations. The success of Cash App in Afghanistan hinges on collaboration between the platform developers, local authorities, and the Afghan population.

As Afghanistan navigates its economic trajectory, embracing innovative digital financial solutions can play a pivotal role in fostering economic growth and inclusivity. Cash App’s entry into the Afghan market could catalyze a positive shift, providing individuals and businesses with efficient, secure, and accessible financial services. The successful implementation of such digital platforms requires a concerted effort from stakeholders to overcome challenges and create an environment conducive to their sustainable operation.