The Canadian dollar, a key player in the global currency market, faces a myriad of challenges that can significantly impact its value and stability in the year 2024. As Canada navigates a complex economic landscape, it’s crucial to examine the potential risks that could pose threats to the Canadian dollar. This article delves into five key risks for the Canadian Dollar in 2024 that warrant attention, shedding light on the factors that might shape the currency’s trajectory in the coming year.

5 Risks for the Canadian Dollar in 2024

1. Global Economic Uncertainty:

The interconnectedness of the global economy means that events on the world stage can have profound implications for individual currencies, including the Canadian dollar. In 2024, the lingering effects of the COVID-19 pandemic, geopolitical tensions, and other macroeconomic uncertainties could cast a shadow over the Canadian dollar’s performance.

Global economic downturns or crises often lead to risk aversion, prompting investors to seek safe-haven assets. While the Canadian dollar is considered a commodity currency and has historically exhibited a degree of correlation with global economic trends, heightened uncertainty may result in capital outflows from riskier assets, including the Canadian dollar. This potential flight to safety could exert downward pressure on the currency.

Moreover, trade tensions between major economies, disruptions in global supply chains, or unforeseen geopolitical events could trigger market volatility, impacting the Canadian dollar’s value. A prudent approach to managing these risks involves close monitoring of international developments and their potential repercussions on the Canadian economy.

2. Commodity Price Volatility:

Canada’s economy is closely tied to commodity prices, particularly oil, as the country is a significant exporter of energy products. The volatility of commodity prices remains a perennial risk for the Canadian dollar. In 2024, factors such as geopolitical tensions in oil-producing regions, shifts in global demand, and efforts to transition to renewable energy sources could contribute to fluctuations in commodity prices.

A decline in oil prices, for instance, could weaken the Canadian dollar by reducing export revenues and negatively impacting the country’s terms of trade. Conversely, a surge in oil prices may provide support to the Canadian dollar. Navigating this risk requires policymakers to stay attuned to developments in the energy market, diversify the economy, and implement prudent fiscal policies to mitigate the impact of commodity price volatility.

3. Monetary Policy Divergence:

Central banks play a pivotal role in influencing currency values through their monetary policy decisions. In 2024, the potential for divergence in monetary policies among major central banks poses a risk for the Canadian dollar. If the Bank of Canada pursues a tightening monetary policy to address inflationary pressures, while other central banks maintain accommodative stances, it could attract foreign capital seeking higher returns.

Conversely, if the Bank of Canada opts for a more dovish approach in response to economic challenges, it may weaken the Canadian dollar relative to currencies with higher interest rates. Striking the right balance in monetary policy becomes crucial, considering both domestic economic conditions and the global monetary environment. Any abrupt or unexpected shifts in policy direction can lead to market volatility and impact the Canadian dollar.

4. Inflationary Pressures:

Inflation is a key determinant of currency values, and 2024 presents a landscape where inflationary pressures could pose risks for the Canadian dollar. Persistent inflationary trends may prompt central banks, including the Bank of Canada, to consider tightening monetary policy to curb rising prices.

However, the challenge lies in managing inflation without stifling economic growth. If inflation surpasses expectations and central banks implement aggressive tightening measures, it could lead to higher interest rates, potentially attracting foreign capital and strengthening the Canadian dollar. Conversely, an inadequate response to inflation could erode confidence in the currency and contribute to depreciation.

Policymakers need to adopt a vigilant stance, closely monitoring inflation indicators and adjusting policies in a timely and measured manner to maintain a delicate balance between price stability and sustainable economic growth.

5. Trade Imbalances and Economic Diversification:

Canada’s trade dynamics play a pivotal role in shaping the strength of the Canadian dollar. Persistent trade imbalances, where imports significantly exceed exports, can contribute to a weakened currency. In 2024, addressing trade imbalances becomes crucial, especially in the context of a globally competitive environment and changing consumer preferences.

A reliance on a limited range of export commodities, coupled with challenges in accessing diverse markets, poses risks to the Canadian economy. Efforts to diversify exports, promote innovation, and enhance competitiveness can contribute to a more resilient economic structure.

Moreover, the evolving landscape of international trade agreements and alliances may impact Canada’s trading relationships. Negotiations and changes in trade policies can have direct implications for the Canadian dollar’s value. Proactive measures to strengthen trade ties, diversify export markets, and enhance economic resilience can mitigate risks associated with trade imbalances.

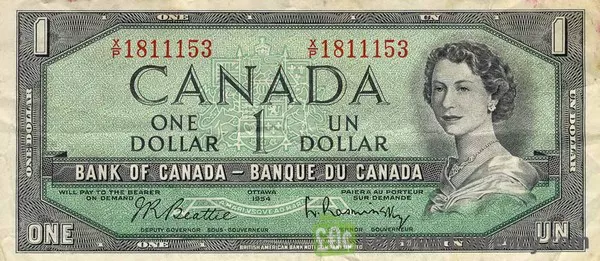

See Also: Canadian Dollar (CAD): History, Symbols, Codes, & Denominations

Conclusion:

The Canadian dollar, as a reflection of the country’s economic health, faces a series of challenges in 2024 that demand careful consideration. The risks associated with global economic uncertainty, commodity price volatility, monetary policy divergence, inflationary pressures, and trade imbalances require a nuanced and strategic approach from policymakers.

A robust response involves a combination of vigilant monitoring, proactive policy adjustments, and initiatives to enhance economic diversification. By addressing these risks head-on, Canada can position itself to navigate the complexities of the global economic landscape and foster a stable and resilient environment for the Canadian dollar in 2024 and beyond.