The strength of a country’s currency is a topic of great interest to economists, investors, and international businesses. For Australia, the performance of its currency, the Australian dollar (AUD), is a key indicator of its economic health and stability. In this article, we will delve into the factors that influence the strength of the Australian currency and analyze its performance in the global foreign exchange markets.

Historical Perspective

Australia has a unique economic landscape characterized by a strong focus on commodity exports, particularly minerals and agricultural products. Historically, the performance of the Australian dollar has been closely tied to global commodity prices, as well as the country’s interest rates and economic indicators. The prosperity of the mining sector and global demand for commodities have provided considerable support for the AUD in the past.

Factors Influencing the Strength of Australia’s Currency

Commodity Prices

Australia is a major exporter of commodities such as iron ore, coal, natural gas, and agricultural products. As a result, fluctuations in global commodity prices have a significant impact on the value of the Australian dollar. When commodity prices rise, Australia’s export revenues increase, leading to stronger demand for the AUD and bolstering its value in the foreign exchange markets.

Interest Rates

The monetary policy decisions of the Reserve Bank of Australia (RBA) play a crucial role in shaping the value of the Australian dollar. Higher interest rates in Australia relative to other developed economies can attract foreign inflows of capital, driving up the demand for the AUD. Conversely, lower interest rates may weaken the currency as investors seek higher returns elsewhere.

Economic Performance

The overall health of the Australian economy, including factors such as GDP growth, employment levels, and inflation, can influence the strength of the currency. A robust economy with low unemployment and steady growth is often associated with a stronger currency, as it signals stability and confidence in the country’s prospects.

Global Market Sentiment

Market sentiment and risk appetite also impact the value of the Australian dollar. During periods of global uncertainty or heightened market volatility, investors may seek safe-haven currencies such as the US dollar, Japanese yen, or Swiss franc, leading to a weakening of the AUD. Conversely, during periods of optimism, the Australian dollar may strengthen as investors seek higher-yielding assets.

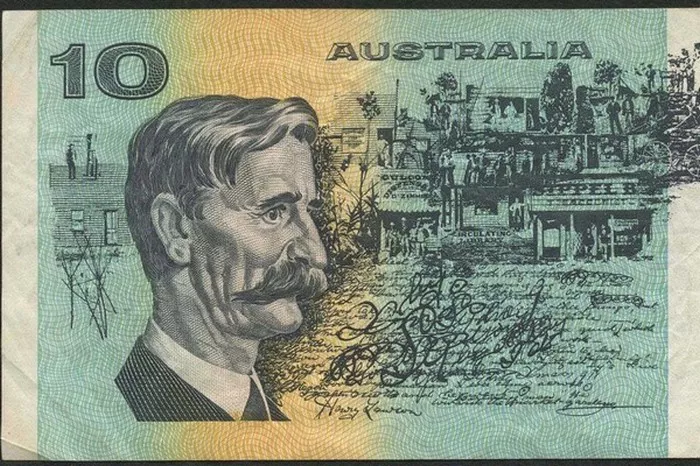

See Also What Is The New Australian Dollar Note?

Recent Performance of the Australian Dollar

As of the latest available data, the Australian dollar has displayed resilience despite the challenges posed by the COVID-19 pandemic and global economic uncertainties. During the initial phase of the pandemic, the AUD experienced significant volatility, reaching multi-year lows against the US dollar. This was driven by fears of a global economic downturn and a flight to safety by investors.

However, as the global economy stabilized and commodity prices rebounded, the Australian dollar staged a remarkable recovery. Strong demand from China, Australia’s largest trading partner, coupled with fiscal stimulus measures and accommodative monetary policy, supported the currency. By mid-2021, the AUD had strengthened to pre-pandemic levels, reflecting the country’s robust economic rebound.

Outlook and Challenges

Looking ahead, several factors are likely to influence the trajectory of the Australian dollar. The continued recovery of the global economy, particularly in major trading partners such as China, will be pivotal in supporting Australia’s export sector and the value of the currency. Additionally, the RBA’s monetary policy decisions and their impact on interest rate differentials will be closely monitored by market participants.

However, challenges remain, including the potential for future disruptions to global trade, shifts in commodity prices, and geopolitical tensions. Australia’s relationship with China, in particular, has been a source of ongoing uncertainty, as changes in trade dynamics can have a significant impact on the Australian economy and its currency.

Conclusion

In conclusion, the strength of Australia’s currency, the Australian dollar, is influenced by a complex interplay of factors including commodity prices, interest rates, economic performance, and global market sentiment. Despite facing challenges, the AUD has exhibited resilience and has been supported by the country’s robust export sector and prudent economic management. As global conditions evolve, the performance of the Australian dollar will continue to be closely monitored as a barometer of the country’s economic health and stability.

As with any currency, the strength of the Australian dollar is subject to a multitude of internal and external influences, and its performance in the foreign exchange markets will continue to be shaped by a dynamic interplay of economic, geopolitical, and market factors.